Products / Information

Telephone Answering Service

Call Routing

Auto Attendant

ACD Software

ACD Systems

IVR Solutions

IVRS

Outbound Telemarketing Services

Call Center Outsourcing

Toll Free Phone Service

IVR Systems

IVR Management

Message Services

Inbound Telemarketing

Other Services

Church Announcements

Health Phone Services

Debt Collection Phone Service

Financial Services

Insurance Marketing Service

Political Calling

Real Estate Services

Education Phone Service

HRD Phone Service

Mortgage Information

Mortgage Marketing Services

Mortgage Marketing Software

Mortgage Application Software

Mortgage Software Application

Mortgage Telemarketing Dialer

Online Mortgage

|

Mortgage Services and Mortgage Marketing Systems

Database Systems Corp. (DSC) is a leading provider of contact center software and phone systems including automatic phone dialers.

Database Systems Corp. (DSC) is a leading provider of contact center software and phone systems including automatic phone dialers.

DSC provides the technology required to improve the productivity of your mortgage and loan application department.

Our mortgage marketing phone system and loan application software can streamline your operation while providing controls and consistency in your loan application process.

Our mortgage telemarketing autodialer can help pre-qualify your mortgage leads and home equity loan leads, sometimes before they even speak with your loan officers. Using our mortgage autodialer phone system with the "Smart" Message Dialing feature, we can call your loan prospects and play a highly focused and custom greeting. We then provide your mortgage prospects the option to talk with one of your loan officers, leave a message, hear additional information such as the latest home loan rate quotes, schedule a call back, or simply decline the service.

Using this service, when your loan officers speak with a prospect, you know there is a high level of interest. No longer will your loan officers spend hours dialing numbers, repeating the same greeting, experiencing a high level of rejection. Your calls will be with highly qualified and interested prospects. Fewer loan officers can process far more mortgage leads and your call success rate can increase dramatically.

Contact Database for a FREE analysis and quote and to learn more about our mortgage marketing service programs.

Mortgage Application Software

DSC has developed online mortgage applications using TELEMATION, our contact management software application. This online CRM software tool is ideally suited for processing mortgage loans, tracking telemarketing mortgage leads and managing customer information.

Our award winning application is employed in a wide variety of organizations including contact centers, help desks, customer service centers, service bureaus, reservation centers and corporate call centers.

The package has extensive computer telephony features and is fully integrated with our marketing phone system. TELEMATION operates on Linux, Unix or Windows servers. Mortgage applications can be quickly developed using the robost features found in our mortgage software toolkit.

Mortgage loan companies such as Advanta Mortgage and Chase Manhattan Mortgage Corporation are just a few of the organizations who have relied upon TELEMATION to handle their data processing requirements.

To view how other businesses and organizations are using our mortgage marketing services, please visit our Mortgage Marketing Customers web page.

Types of Mortgage Phone Dialing Campaigns

- Automatic Mortgage Lead Dialing

- This traditional method of calling dials a number from a phone list when a loan officer is available to make a call. When the number is dialed, the phone system transfers the mortgage lead to the loan officer.

This method simply relieves your loan officers from the tedium of manually dialing mortgage loan leads.

This type of calling is appropriate when your mortgage loan program is more complex and needs more explanation and personal interaction.

- Mortgage Voice Message Broadcasting

- This is another method of calling where the phone system dials from a list and plays a pre-recorded message either to an individual or to an answering machine. A mortgage loan officer is not required.

This technique could be useful when you wish to inform a potential customer of an upcoming program, or to provide instructions on how to contact your mortgage center and apply for a loan.

- Mortgage Message Broadcasting and Touchphone Response

- This method expands the prior message broadcasting technique by playing a message that gives the potential customer options from which to select. Using touchphone responses such as "Press 1 for...", options could include obtaining additional information, being removed from the call list, loan qualification requirements, leaving a voice message, or speaking with a mortgage loan officer.

A different message can be left on an answering machine.

- Mortgage Predictive Dialing

- Predictive dialing is very similar to automatic dialing, except the phone system dials several numbers ahead to reduce the amount of wait time between calls that your loan officers handle. This greatly increases your loan officer productivity, but may lead to lost calls because the mortgage lead auto dialer contacts an individual when no home loan officer is available.

- "Smart" Mortgage Message Dialing

- This type of calling campaign blends Message Broadcasting with Predictive Dialing and can produce very productive results. Messages are played to potential clients, and if the individual expresses an interest in your mortgage or home equity loan program, the call can be transferred immediately to one of your home loan officers.

A separate phone message can be left on an answering machine.

Database Systems can provide any type of calling program required by your organization and can even blend several types using our mortgage autodialer to determine what works best for your specific marketing program.

NOTE: Certain telemarketing activities and the use of pre-recorded messages and predictive dialers are governed by state and federal law. Please familiarize yourself with these laws and regulations.

A component of the Dow Jones Industrial Average, JPMorgan Chase is headquartered in New York and serves more than 30 million consumer customers and the world's most prominent corporate, institutional and government clients.

Chase Manhattan Mortgage Corporation (CMMC) uses our TELEMATION mortgage software application to qualify leads and prospects. Using information maintained in its database of prospects and clients, Chase service representatives and loan officers interact with callers. Our mortgage software assists loan officers with call history, loan qualification calculations and new product information.

TELEMATION is fully integrated with CMMC's phone system and provides caller information automatically.

|

|

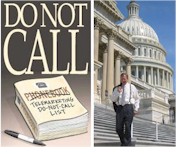

Automatic "Opt Out" Features and FTC Compliance

More than just "Do Not Call" list verification. Like some dialers, we fully support a Do Not Call list check prior to calling your phone lists. However, another important FTC regulation is all but ignored by most predictive dialers.

Because of the new FTC regulations, it is now more important than ever that your automatic Message Dialer gives call recipients the option to be removed from your calling lists.

Our voice broadcasting phone dialer has an automatic "Opt Out" option that lets the recipient simply "Press 1...." and the dialed phone number will automatically be placed in a Do Not Call list maintained in the PACER and WIZARD dialer. Subsequent phone lists will be checked against this DNC file.

Additionally, the FTC requires a caller ID be provided with all telemarketing related calls. This number can be answered automatically by our integrated Opt Out program and the caller can remove the phone number by simply entering it on the touchphone keypad.

This totally automatic "Opt Out" process requires no human intervention and satisfies the new FTC rules.

Work From Home Mortgage Loan Officers

An important benefit of today's telecommunication advancement is the ability for your employees to work from home. Database Systems Corp. has developed a family of telecom products that promote this capability.

Our PACER mortgage dialer system, combined with our CRM application software and computer telephony products, fully supports remote agents and work at home employees.

Now your mortgage loan officer base can be significantly expanded with the addition of work at home employees. The economic savings and environmental advantages are significant.

To obtain additional information about remote agent capability, you may view our Remote Agent page.

An important benefit of today's telecommunication advancement is the ability for your employees to work from home. Database Systems Corp. has developed a family of telecom products that promote this capability.

Our PACER mortgage dialer system, combined with our CRM application software and computer telephony products, fully supports remote agents and work at home employees.

Now your mortgage loan officer base can be significantly expanded with the addition of work at home employees. The economic savings and environmental advantages are significant.

To obtain additional information about remote agent capability, you may view our Remote Agent page.

Mortgage Lead Qualification and Autodialer Benefits

- Consistent Greeting and Introduction

- Maximized Mortgage Loan Officer Productivity

- Process Mortgage Leads and Mortgage Prospects

- Track Telemarketing Mortgage Leads

- Home Mortgage Loans and Home Equity Loans

- Increased Mortgage Loan Officer Success and Morale

- Enhanced Cost Savings!

- Improved Control of Mortgage Prospects

- Efficient Use of Resources

- Expanded Information Capability

Contact Database Systems Corp. Today

Contact Database to learn more about our mortgage marketing phone service.

|

Database Systems Corp. (DSC) is a leading provider of contact center software and phone systems including automatic phone dialers.

Database Systems Corp. (DSC) is a leading provider of contact center software and phone systems including automatic phone dialers.

An important benefit of today's telecommunication advancement is the ability for your employees to work from home. Database Systems Corp. has developed a family of telecom products that promote this capability.

Our PACER mortgage dialer system, combined with our CRM application software and computer telephony products, fully supports remote agents and work at home employees.

Now your mortgage loan officer base can be significantly expanded with the addition of work at home employees. The economic savings and environmental advantages are significant.

To obtain additional information about remote agent capability, you may view our Remote Agent page.

An important benefit of today's telecommunication advancement is the ability for your employees to work from home. Database Systems Corp. has developed a family of telecom products that promote this capability.

Our PACER mortgage dialer system, combined with our CRM application software and computer telephony products, fully supports remote agents and work at home employees.

Now your mortgage loan officer base can be significantly expanded with the addition of work at home employees. The economic savings and environmental advantages are significant.

To obtain additional information about remote agent capability, you may view our Remote Agent page.